What Policies Are Included In Lawn Care Insurance

The exact policies in your lawn care insurance will depend on many factors. If you are a small enterprise with no employees, your insurance needs will differ from a small business that runs an office. To know what is best for your business, discuss the available options with your insurance provider. Even though there is variability in the packages offered, the insurance typically includes:

Environmental And Occupational Impact

A 2001 study showed that some mowers produce the same amount of pollution in one hour as driving a 1992 model vehicle for 650 miles . Another estimate puts the amount of pollution from a lawn mower at four times the amount from a car, per hour, although this report is no longer available. Beginning in 2011, the United States Environmental Protection Agency set standards for lawn equipment emissions and expects a reduction of at least 35 percent.

Lawn mowers produce GHG emissions. A minimum-maintained lawn management practice with clipping recycling, and minimum irrigation and mowing, is recommended to mitigate global warming effects from urban turfgrass system

Mowers can create significant noise pollution, and could cause hearing loss if used without hearing protection for prolonged periods of time. Lawn mowers also present an occupational hearing hazard to the nearly 1 million people who work in lawn service and ground-keeping. One study assessed the occupational noise exposure among groundskeepers at several North Carolina public universities and found noise levels from push lawn mowers measured between 86-95 decibels and from riding lawn mowers between 88 and 96 dB both types exceeded the National Institute for Occupational Safety and Health Recommended Exposure Limit of 85 dB.

The risk of hearing loss and noise pollution can be reduced by using battery-operated mowers or appropriate hearing protection such as earplugs or earmuffs.

Who Files The Claim

As I searched through different websites that educate people on how homeowner insurance works, how to file a claim, and what situations the homeowner is liable for, I came across a pretty decent answer.

In a nutshell, if a piece of your property damages your neighbors property, then your neighbor has to file an insurance claim.

Your neighbor has to file the claim because their house or their property has been damaged.

Anytime there is some damage to the house, the insurance company must know about it, even if it is not enough to file a claim.

Also Check: How To Clean Outdoor Cushions With Mold

Expert Tips On How To Buy Personal Liability Insurance

Personal liability is an absolute necessity, as you never know when an accident or error in judgment can have a major impact on your life. Liability insurance is essentially asset protection, says Thomas J. Simeone with Simeone & Miller in Washington D.C.

A mistake or accident can quickly put all of your assets at risk if you are not properly insured. And, if you think it wont happen to you, think again.

In one case, we collected $100,000 from a homeowners policy when a woman negligently rode her bike through a crosswalk and injured our client, who was a pedestrian, says Simeone. And in another, we settled for $300,000 where a woman was walking her dog and it bit the ear of a child.

Here are a few tips from some industry experts regarding personal liability coverage:

Liability Insurance Protects You Against Negligence Lawsuits

Section II of your homeowners insurance comes into play when you or someone you invite onto your property are injured because of negligence. It pays for medical expenses and certain other costs related to personal injury or illness that happened on your property.

The insured covered under the policy includes anyone specifically named in the policy as well as their spouses, family members living in the home, and children under age 21 under the care of someone else covered by the policy. Homeowners insurance benefits are also available when a friend, acquaintance, or visitor is injured in your home.

An example of liability insurance covers premises liability claims that result after a contractor is injured by exposed wires in your home. Since you, as the homeowner, have certain obligations to keep your home safe, when you invite a person into your home and they are injured by the exposed wires, you could be held liable. If you are sued, it is up to your insurance company to pay your legal fees in defending the case and pay any settlement or jury award up to the policy limits.

Read Also: How Much For Trugreen Service

An Invited Guest Is Injured Will I Be Covered

Yes, guests you invite are covered under your liability coverage under the homeowners policy. This coverage will pay for their medical bills, lost time, pain and suffering, and any other damages up to the policy limit.

The homeowners policy also covers defense costs if your friend or their insurance company sues you. Your homeowners insurance will pay for an attorney to defend you and the insurance company. The costs of defense are included in the liability limit.

Medical payments coverage will pay for medical bills incurred by guests on your property, whether you are legally liable or not. It has a much lower limit than your liability and is considered a goodwill coverage.

If you have a $100,000 limit and your friends claim is $80,000, that leaves you $20,000 for defense costs before you have to pay. Make sure your liability limit is enough to pay for any claims and defense costs that arise.

In some claims, like a friend slips and falls on your kitchen floor you just mopped, they must prove negligence on your part. If your friend falls and you are not negligent your medical payments coverage may pay for their injuries.

For other claims, like your dog bites a friend, they do not have to prove you were negligent. It depends on your state law if your state is governed by a strict liability for attractive nuisances like dog bites, swimming pools, and trampolines.

How To Get Personal Liability Insurance

Yes, personal liability insurance is worth it, if someone is injured at your home, if you have a dog that bites an invited guest or if you are to blame for any accidents happening on premises this coverage will help pay for the medical bills orIn order to make sure that you are adequately covered for your home or rental, it is important to look at the amount of personal liability coverage and limits in place. As you increase the value of your home or whats inside, you should contact your insurer to make sure you have enough coverage, and everything is covered.

Don’t Miss: Does Baking Soda Kill Clover Mites

How Personal Liability Insurance Policies Work Together

Personal liability coverage provides protection to you in case of injury or destruction to someone elses property. Insurance policies work hand in hand and build upon each other. Your homeowners personal liability insurance, for example, can only provide a certain amount of coveragesay $300,000. And your umbrella policy is limited to the same amount. This means that if youre sued in an incident covered by both policies and need more than $600,000 worth of coverages then its going to take both policies combined to fill the gap.

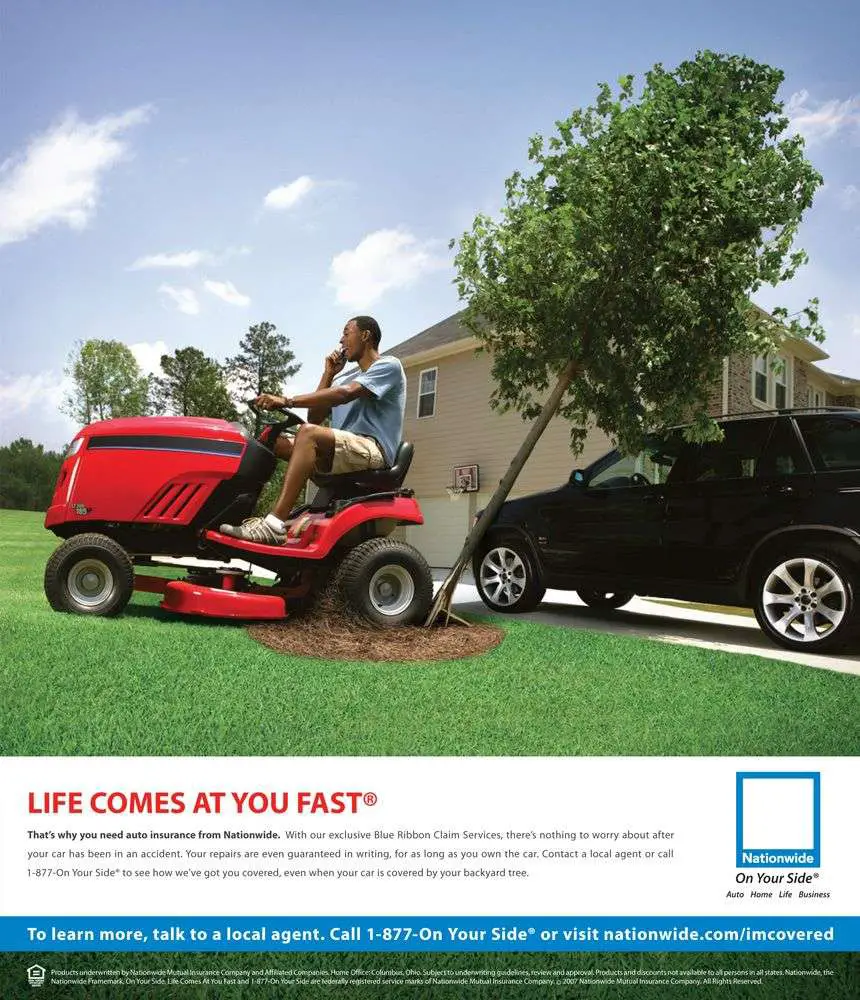

How To Buy Insurance For Your Lawn Mower

When shopping for a lawn mower insurance policy, here is what you need to consider.

- Research and purchase the right policy that meets your demands and requirements.

- The idea should focus on general liability if your lawn mower causes personal injury or damages a third-party property.

- Buy from a trusted insurance agent who can offer expertise.

- Compare the quotes and understand the policy coverage of various insurance policies before you finalize one. Check the claim settlement time and ratio.

- Always prioritize the quality of coverage over cost. Never fall for policies that offer low premiums but a high deductible. If you lose essential or expensive gear, then a high deductible means shelling out more money from your pocket.

- Read the insurance policy before you sign and get all the terms and conditions clarified by the agent. Being clear on the details lets you manage risks and be better planned for emergencies.

Also Check: How To Kill Clovers Without Killing Grass

Does Homeowners Insurance Cover Water Damage From Leaking Plumbing

Homeowners insurance may help cover damage caused by leaking plumbing if the leak is sudden and accidental, such as if a washing machine supply hose suddenly breaks or a pipe bursts. However, homeowners insurance does not cover damage resulting from poor maintenance. So, if damage results after you fail to repair a leaky toilet, for example, homeowners insurance likely will not pay for repairs.

What Is The Best Home Insurance Company

The best homeowners insurance company for you depends on your specific rating factors, like the age of your house, its location, your coverage needs, your budget and more. You might be able to find a company that fits your needs by obtaining quotes from several carriers. This could allow you to compare the coverage options so you can find the protections you are seeking.

Also Check: Hydroseeded Lawn Patchy

If The Tree Falls On Your Yard Or An Empty Space Due To Wind Hail Snow Or Ice

If a tree falls because of wind, hail, or the weight of snow or ice, insurance will only cover the removal if it lands on a covered structure on your property or blocks your driveway. That means if a windstorm knocks your tree over and it lands on your lawn, backyard, or garden, you likely wonât be covered for removal services.

Home Insurance Deductibles And Limits

Keep in mind that you’ll likely need to pay your deductible toward a broken window claim. Your deductible is the amount you pay out of pocket before your insurance kicks in to help cover the claim. You can usually choose your deductible when you purchase homeowners insurance.

If the cost of repairing a broken window is less than your deductible, you will have to pay for repairs yourself . But if your deductible is lower than the cost of the window repair, your homeowners insurance will likely help pay the difference, up to your coverage limit. A coverage limit is the maximum amount your insurer will pay toward a covered claim.

Say your window is damaged during a break-in, and repairs will cost $700. But, your dwelling coverage deductible is $1,000. You would have to pay for repairs entirely out of your own pocket. Now, suppose you had a $500 deductible. You would pay $500 toward the window repair, and your insurer would reimburse you for the additional $200.

You May Like: Craftsman Lt1000 Oil Capacity

What Is And Isnt Covered By Homeowners Insurance

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Properly understanding what is and isnt covered by homeowners insurance requires policyholders to ask a lot of questions and to read the fine print on their insurance contractbefore they purchase a policy. Although every homeowners insurance policy is different, there are some things that almost all insurance policies have in common.

Is Personal Liability Insurance Worth

Yes, personal liability insurance is worth it, if someone is injured at your home, if you have a dog that bites an invited guest or if you are to blame for any accidents happening on premises this coverage will help pay for the medical bills or any kind of bodily injury or property damage you cause to others.

Recommended Reading: Keep Rabbits Off Your Lawn

How Much Is Small Business Property Insurance

In addition to the median cost of 63 dollars per month, the average cost of commercial property insurance is $755 per year with a $60,000 limit and a $1,000 deductible. Since it excludes outlier premiums that are too high and too low, the median is a more accurate measurement of what your business will likely pay.

How Much Does Personal Liability Insurance Cost

How much is personal liability insurance? Fortunately, its reasonable.

Again, typically, it comes as part of a standard home insurance policy, and it isnt usually something you can purchase by itself.

But if youre looking for a breakdown on how much liability is, here you go:

According to an Insure.com rate analysis, youre typically paying around $10 a year for every $100,000 in coverage. So, for half a million in liability, youre paying approximately $50 a year or a little over $4 a month.

You May Like: How Much Does Trugreen Cost Per Month

What’s Not Covered On A Standard Homeowners Insurance Policy

The standard homeowners insurance policy, also known as an HO-3, covers your home for multiple perils, but there are some important exclusions. Knowing what’s covered and what isn’t can save you a lot of money and heartache down the line.

Earthquake and water damage

In most states, earthquakes, sinkholes, and other earth movements are not covered by your standard policy. Earthquake insurance can be purchased as an endorsement for an additional fee in all states except California. Flood insurance, which also includes mudflow, must be purchased as a separate policy and is available only through the government-run National Flood Insurance Program.

Other types of water damage are also excluded. If you have overflows or backups from your sump pump, sewer system or drains, your standard policy will not cover the damage. Coverage may be available, however, by adding a separate endorsement.

Maintenance issues

Taking proper care of your home can keep you from having to pay for costly repairs your homeowners insurance won’t cover.

Many things that aren’t covered under your standard policy typically result from neglect and a failure to properly maintain the property. Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered.

Other exclusions

Minimal coverage

Minimal coverage is provided for the following:

Named Peril Vs Open Peril

What exact perils are you covered for in your policy? You may find either named peril or open peril coverage, depending on what type of policy you choose. Named peril means your policy covers the listed damages typically 16 in a standard policy in your package, but nothing outside of those. Those perils are:

- Windstorm or hail

- Weight of ice, snow, or sleet

- Accident discharge or overflow of water or steam

- Sudden and accidental tearing apart, burning, or bulging

- Freezing

- Sudden and accidental discharge from artificially generated electrical current

Open peril means your policy covers everything except whats specifically listed as excluded in your policy. This is usually a broader level of coverage.

Some policies might include named perils for some coverage and open peril for others, to make matters more confusing. For example, in an HO-3 policy , you may have open peril coverage for your dwelling, but named peril coverage for your personal property.

Also Check: How To Get Lawn Mowing Jobs

Other People Injuring Themselves At Your Property

If other people are injured by lawn mowers on your property, homeowners insurance will rarely be able to cover their medical bills to the full extent. If a family member or a worker is injured while mowing the lawn, you can file a claim for liability insurance to cover their medical bills. Each HO-3 plan has a certain liability insurance limit that is used for other peoples injuries on your property.

Liability insurance does NOT have high coverage on homeowners plans and many times its insufficient to cover the full medical costs. This form of insurance can also be used for legal costs if youre sued by a worker. This is why you should increase the limits on your liability insurance in advance.

Children tend to mow the lawn often and more than 9,400 are hospitalized each year for lawn mower injuries. Nearly 7% of those injuries are serious and end up in hospitalization for the child. This means lawnmower accidents have a higher hospitalization rate than other consumer product injuries. Injuries are also common for landscaping company staff and most of these injuries end up costing tens of thousands of dollars. In most cases, liability insurance claims also require evidence that the owner of the plan was negligible in the accident. Youll have to prove you didnt know the lawnmower could malfunction and lead to an accident.

What Kind Of Insurance Should A Landscaper Have

Liability and workers’ compensation insurance are the two types of insurance that landscaping companies should carry at a minimum. If one of your workers becomes injured on your property, workers’ compensation will cover him or her. In the event your home is damaged, your liability insurance will pay for it.

Don’t Miss: How Much Weed And Feed For 1 2 Acre

Does Personal Liability Insurance Cover Injury To My Home Or Household Members

Surprising as it may sound, no.

That said, if youre showing off in front of your kids, and you go skateboarding in your kitchen, and you forget that the door to the basement is open, and down the stairs you go, you probably werent planning on suing yourself or a family member for negligence. And you have health insurance, right? Boy, we hope so.

And keep in mind that if your kids friend happened to be on a skateboard and went careening down some stairs or over your coffee table and injured himself your personal liability coverage would cover those hospital bills and any possible lawsuit.

Personal liability coverage, all in all, doesnt cost all that much, but the cost of not having it when you need it can be very high.